Hurray! YOUR Invest 2026 Traders & Investors Summit Have Been Reserved. Don't Miss your opportunity to get the best out of the market in 2026...Take Action Now

Hello Investors and Traders,

Planning is the process of thinking about and organizing the activities required to achieve a desired goal. It is the fundamental bridge between where we are now (the present) and where we want to be (the future).

The year is coming to an end and whether you like it or not, 2026 is going to come whether you have planned about it or not. This goes not to emphasize on the importance of planning your new year. However, in this case, we will be looking at financial growth.

When I mentioned planning, it is not just to plan but also to take action where the need be in other to protect your investment...

Because it is absolutely the only thing that you have control over. You can't control the government or economic policies bearing in mind that alot of political activities is going to happen.

Planning: The Foundation of Successful Investing

Before you invest a single Naira, you must have a plan. Without a plan, investing is just gambling. Apart of Key Elements of a Financial/Investment Plan, you must understand you need to do the following:

· Start Early & Invest Regularly: The power of compounding is your greatest ally. Consistent investing (e.g., dollar-cost averaging) reduces the impact of market volatility.

· Diversification ("Don't put all your eggs in one basket"): This is the practical implementation of your asset allocation. Spread your investments within each asset class (e.g., different industries, countries, company sizes).

· Cost Awareness: High fees (expense ratios, transaction fees, advisor fees) can severely erode your long-term returns.

· Long-Term Discipline: The market will fluctuate. A well-constructed plan gives you the confidence to stay the course during downturns instead of panicking and selling at a loss. Your plan should be your anchor in a storm of market noise.

The Pre-Election Year Playbook

The pre-election year in Nigeria often serves as a period of notable opportunity for stock market investors, distinct from the volatility that characterizes the election year itself. Driven by an expansionary fiscal policy, the government typically ramps up spending on infrastructure and social programs, injecting liquidity into the economy. This fiscal stimulus acts as a catalyst, boosting corporate earnings for consumer goods and industrial sectors and improving profitability for banks. Historically, this has fueled a 'pre-election rally,' making it a strategically advantageous time for investors to build positions before the heightened uncertainty of the election year prompts a market reassessment.

The pre-election year is frequently the strongest period in the entire 4-year election cycle for the Nigerian stock market. This might seem counterintuitive, but it's driven by a clear and powerful political logic.

Key Drivers of the Pre-Election Year Market

1. Expansionary Fiscal Policy (The "Sugar Rush")

2. Positive Investor Sentiment and "Pre-Election Rally"

3. Relative Political Calm

In Pre-Election cycles, this pattern is often observable:

· Pre-Election 2022 (Before 2023 Elections): The NGX All-Share Index (NGXASI) delivered a return of ~19.98% for the year, one of its best performances in the decade, significantly outperforming the election year of 2023.

· Pre-Election 2018 (Before 2019 Elections): The market closed 2018 on a negative note, but this was an anomaly heavily influenced by a global monetary policy shift and specific local issues. However, there was a significant rally in the first half of the year before it tapered off.

· Pre-Election 2014 (Before 2015 Elections): The market was up significantly, driven by high oil prices and robust government spending, before crashing in the election year of 2015 due to the oil price collapse and intense political uncertainty.

So, being a pre-election season, 2026 is not just another year. It is part of a powerful historical trend or pattern that smart traders or discerning investors should be abreast of in any investment window, market or exchange in Nigeria today. It comes with tradable opportunities and risks that are associated with elections and post-elections. The ability to navigate between politics and economy creates the wealth that makes the difference in your investment. The reading of a nation’s electoral cycle and how investors perceive whether there could be a change in leadership, or a continuity, is a major factor that results in much of the uncertainty for which pre-election years have been known. This, it is believed, can and does spike market volatility and businesses, especially when it is seen that a new political party may take power. This summit will empower market players to navigate 2026 profitably by maximizing gains and minimize losses.

One can say that planning ahead of 2026 Pre-Election year gives you the blueprint of how to manage your investments in 2026, the exact stocks that will help you reach your 2026 investment target especially during the pre-election year. It is either you plan to succeed or you follow the crowd who don't understand how things work in the market in 2026.

I know that you will be wondering how can you plan and succeed in your 2026 investment goals especially now there will be a lot of noise to distract you in a pre-election year. However, you do not need to bother much because InvestData Consulting Limited is available to continue to render learning and financial education so that we can always take advantage of the market to enhance our hard-earned money in any market cycle. In addition, InvestData will also help you with the sectors of the economy that will boom next year and also know the exact stocks to put your hard-earned cash and get the best out of it.

As a result, I hereby announce the Invest 2026 Traders & Investors’ Summit. Theme: Pre-Election Year Investment Opportunities & Risks. It will hold Saturday

Date: 6th December, 2025

Time: 9:00am

Venue: Zoom.

Wondering??? Why you must not miss the Invest 2026 Summit?

Invest 2026 Summit is a not-to-be missed summit capable of completely changing your view about where the economy and stock market are headed and when you should fully plunge in or hold cash. Join the experts and experienced professionals to discuss a Big Picture Perspective of where the stock market and other investment windows are currently placed and what signs to be vigilant about over the coming months and year 2026. Don’t miss this summit.

We have held this annual summit since 2012, to give investor and traders insight, perspective and expectations in the new year. This year's Invest 2026 Summit is exceptional The big picture of what is happening and the outlook for 2026 being a time of financial reset across the economy, an election year, analysis of the status of different investment windows and opportunities, ranging from the economy, equity, bond, commodity, real estate and others using fundamental and technical tools.

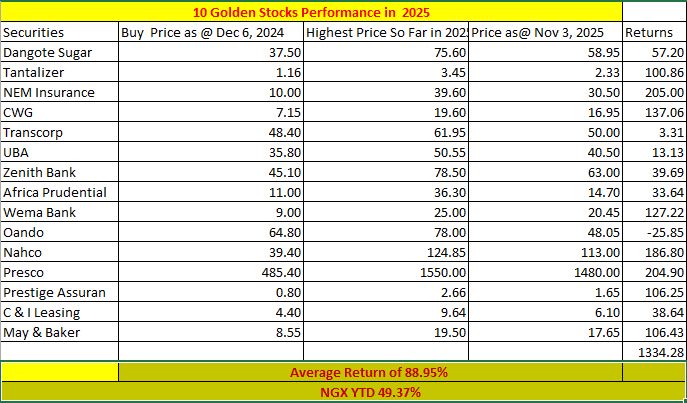

In a market of 5 Months downturn, More than 50% of the golden stocks pick during Invest 2025 Summit did well; returning an average of 88.95% even though the general market average return was 49.37% YTD. See the table below calculated based on the assumption that you have not sold your position to date. However, smart investors who know when to go in and out would have cash out BIG TIME.

Click below to Watch a Comprehensive Analysis so that you can have a deep understanding of the above analysis.

Great! Apart from the Hot Stocks which I can't wait to take position in 2026, what other benefit will I get?

To effectively take advantage of changing trading patterns and the oscillating stock market, active traders and investors must stay ahead of the new market structure and conversant with strategies used by institutional investors or smart money.

So in this EIGHT-HOUR class, you will learn strategies and techniques on how to create cash flow and capture winning trades in any market cycle.

- What to expect from the market and economy as the new tax reforms kick off in 2026.

- Why historical patterns and trends in Nigeria’s election cycle is important when taking your investment decisions in 2026 and beyond

- The power of liquidity and corporate earnings in price movement.

- How to anticipate big sector moves and recovery in 2026 with the ongoing reforms

- Understanding the 4-year cycle of opportunities and time frames that come with preparation for election in Nigeria

- 10 golden stocks for 2026

How much is Registration Fee?

As you know that the usual price for the InvestData past summit is N75,000 and the prize still remain the same thing. However, I always like to reward investors who like to take immediate action. As a result, there will be a discount so that everyone can participate irrespective of your membership status

Decision Time!

Now, here is the decision time, in other to finalize your spot for the InvestData 2026 Seminar Via Zoom on 6th December, 2025 09:00am Prompt, you need to complete the below STEP

Please Pay a discounted fee of N50,000 into InvestData Consulting Limited Zenith Bank 1013815737. After Payment Send the details of your payment including name, email address and phone number to 08028164085 to complete your reservation before closes on the 1st December 2025.

Like I promised, Below are the 8 analysts (plus the topics they will be analyzing) that have been selected to handle core topics capable of giving a full grasp of InvestData 2026 Workshop. See you on the other side of winners...

Dr Sylvester Anaba (PhD, FCS) , Head Research, United Capital Plc

Investment Opportunities In The Alternative Markets In 2026 & Beyond

Mr Teriba Adeboye, , MD/CEO, Qualinvest Capital ltd

Pre-Election Year Rally: How Economic Events & Tax Reforms Will Fuel Bull Or Bear Cases In 2026

Mr Abdul-Rasheed Momoh, ED Operations, TRW Stockbrokers Ltd

New Highs & Correction on NGX: The Power Of Price Action, Time & Momentum In Profitable Trading In 2026 & Beyond

Mr Abiola Rasaq, Former Head, Investor Relations & Portfolio Investments United Bank For Africa Plc

The Pre-election Economy & 2026 Budget: Implementation and Impact On NGX

Mr. Peter Sunday Adebola, Managing Director/CEO Edgefield Capital Management Ltd

Comprehensive Earnings Guide for Profitable Investing and Trading in 2026

Mr Kebira Jimoh Aruna, MD/CEO GlobalView Capital Ltd

Strategies For Equity Investing & Trading In A Pre-Election Year

Mr Tope Ojo, Managing Partner, Tope & Tunde Estate Surveyors & Valuers

Nigeria Infrastructural Gap & Fiscal Policy Reforms: Where to find Investment Opportunities in 2026

Mr. Ambrose Omordion, CRO Investdata Consulting Ltd

NGX Pre-Election Year Performance & Historical Patterns:10 Golden Stocks For Profitably Investing